Overview

Virtual Cards form part of a broader strategy to modernize platforms that support digital-first processes to deliver superior products and service experiences to customers. Today's cardholder do not wait the conventional 7 days to receive a new or replaced card and would rather switch to a different provider.

In order to avoid customer churn and meet their expectations, it has become essential for financial institutions to empower them with convenience both offline and online with digital-first solutions. FSS Unified Issuance Platform powers Virtual Cards -- completely customizable digital cards which are instantly available to transact and are end-to-end secure -- for banks, NBFCs, neo-banks and digital-only banks.

0 Min

1st

0 M

0 M

Customer Stories

The company is an Indian financial services company focused on lending, asset management, wealth management and insurance. Instant EMI is a payment instrument that converts all purchases into easy EMIs. FSS Virtual Cards enable the company to

- Instantly generate digital cards with a 100% digital process

- Instant approval under 30 seconds

FSS Virtual Cards are powering YAP, UAE's most innovative digital banking app, that enables its users to maintain healthy spending habits with intuitive card controls. FSS offering enables YAP to

- Instantly issue virtual cards within 30 seconds

- Provides dynamic card control

- Protect against fraud using 3D Secure

World's first cooperative neo-bank has partnered with FSS to bring its members together around the world's number one marketplace - household consumption. It allows its customers to recover large parts of the shopping purchase as purchase credits. FSS Virtual Cards support multiple wallets - open loop wallet as well as closed loop wallet.

For the purchases made within the bank's affiliate network, customers receive loyalty points and customers have the flexibility to use a combination of funds and loyalty points available in the wallet.

60+ Advanced Lightweight APIs

Card Issuance APIs

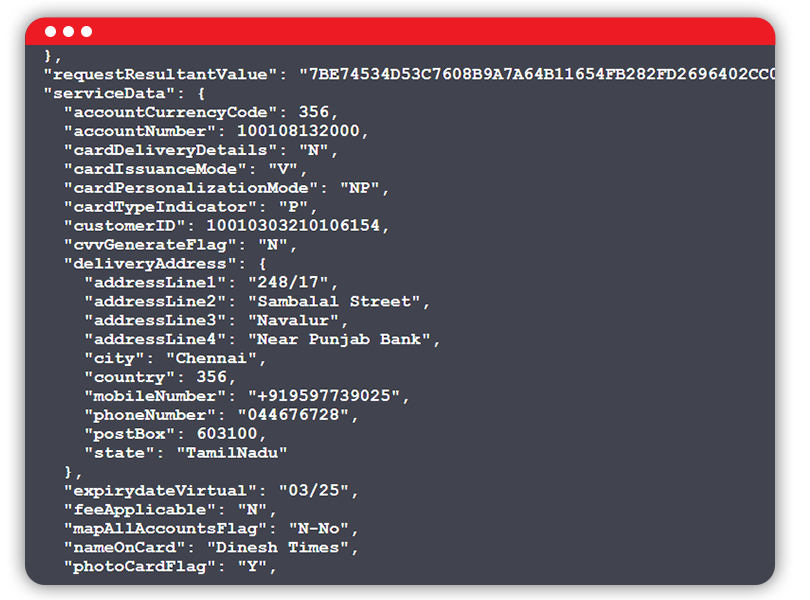

Customer onboarding, Issue a physical (P) or virtual (V) card, Customer signup and auto-fetch customer name, Generate CVV2 for a given card, Restrict customers and maintain a negative listAccount Control APIs

Close card account, Link/Delink a secondary account to card, Swap card accounts, Upgrade card accountWallet Control APIs

Multi wallet issuance, Transfer monies between wallets, Add, delete, block or unblock wallet, Modify wallet expiry , Define exchange rate for multi-currency walletsCard Function APIs

View account details, Update customer profile, Fetch card balance , Retrieve last 10 transactions, Retrieve last 90 days transaction, Fetch complete transaction details, Reset card PINTransaction Function APIs

Move funds, Adjust debit/credit limit of prepaid card wallet, Generate report of unsettled transactionsKey Capabilities

Supports Open Loop Cards

Programmable Card Controls

Completely Secure Against Fraud

60+ Advanced Lightweight APIs

FSS Virtual Cards are built on an API-based modular framework with 60+ APIs across

- Card Issuance - Onboarding, Signup, Detail Auto-fetch, CVV2 Generation

- Card Function - View Account Details, Profile Updation, Retrieve Last Transactions, Reset Card PIN

- Account Control - Close Card Account, Link/Delink Secondary Account, Swap Account, Upgrade Account

- Transaction Function - Move Funds, Adjust Debit/Credit Limit

- Wallet Control - Multi-wallet Issuance, Inter-wallet Money Transfer, Add/Delete/Unblock Wallet, Modify Wallet Expiry, Define Exchange Rate for Multi-currency Wallet

Use Cases

Ecommerce Payments

Single use virtual cards for one-time purchase

Embedded Payments

Wearables and IoT device transactions using tokenization

Corporate Payments

Expense cards for employees, Supplier payments

Government Disbursements

Direct benefits transfer, for ex, flood relief vouchers

Travel Payments

Supports creation of wallet in local currency

Payroll

Payments made to gig workers